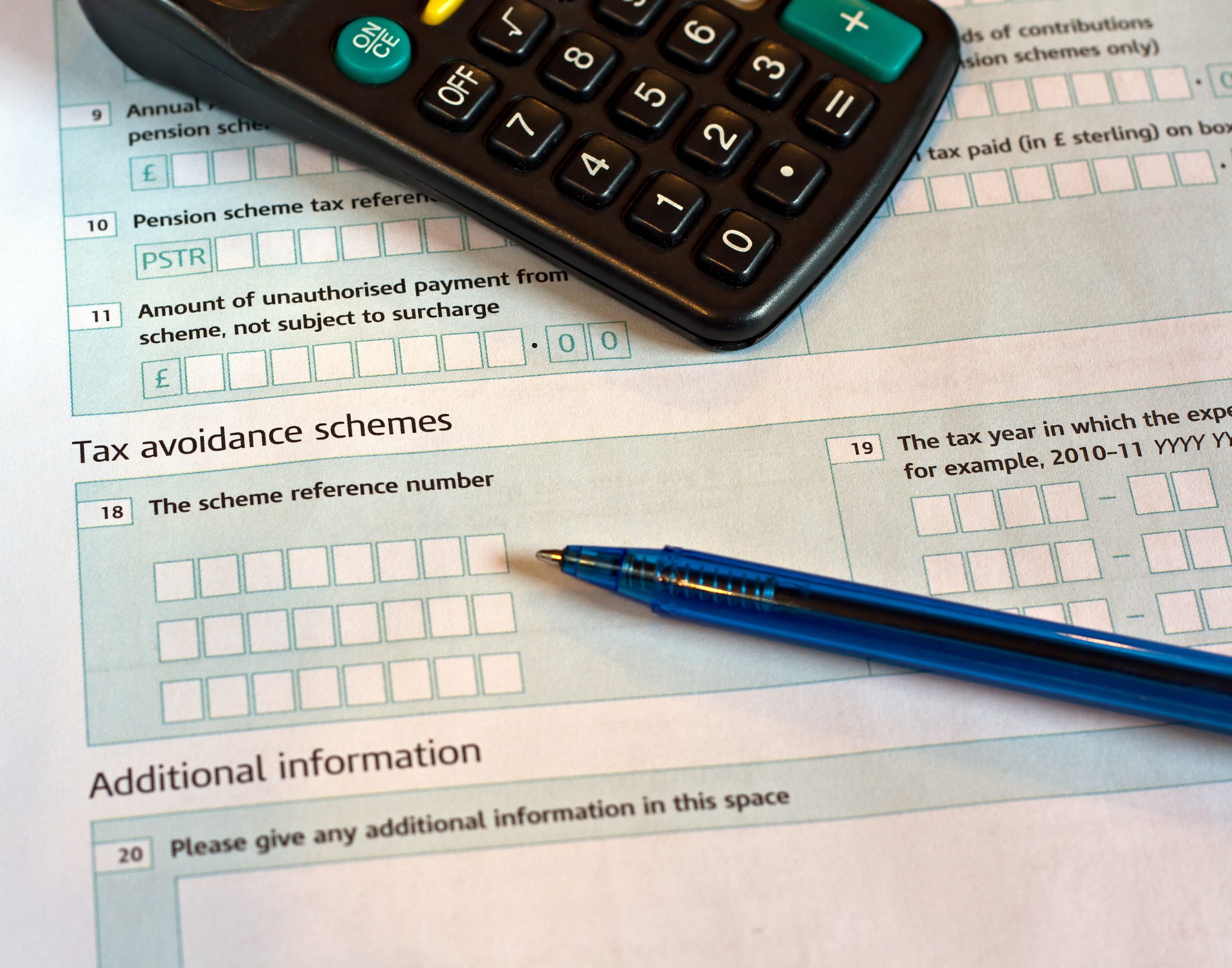

Personal Tax

Our personal tax services provide expert guidance to optimise your tax returns, ensuring compliance while maximising your savings and financial potential.

You know there are specific times for tax considerations; however, regular and proactive tax planning can significantly reduce your bill. With our help, you can therefore make informed decisions about factors influencing your tax liability and maximise available reliefs, allowances, and credits.

Navigating the Complex UK Personal Tax System

The UK tax system has become increasingly complex, with various taxes overlapping and interacting. Consequently, now, more than ever, having a personal tax accountant is crucial. Not only can they guide you through the maze, but they can also ensure you receive the right advice.

At ABS Accountancy, we are not only entrepreneurs but also small business accountants and tax experts. Furthermore, we are committed to helping you save as much tax as possible within regulations. In addition, we can assist you in achieving your wealth and passive income goals for your family pot.

This list is not exhaustive. Generally, if you earn any untaxed income over £1,000, you are required to file a tax return. If you’re unsure, it’s highly recommended to speak with our tax team. You need to complete a self-assessment return if you:- Are a self-employed small business owner and earn over £1k per year

- Are in a business partnership

- Earn more than £100k as a salary

- Receive property rental income of over £1k

- Receive income from dividends, savings, or foreign sources

- Have capital gains tax obligations

Expert Tax Services for Directors and Business Owners

We start by assessing your financial situation and discussing your future goals. This process helps us define the right plan of action. As independent tax advisors, we always prioritise your best interests. Moreover, we offer tax-saving opportunities supported by a solid commercial foundation.

When did you last review your remuneration strategy? If unsure, rest assured all our packages include annual planning for business owners, covering efficient profit extraction through salary, dividends, or both, helping you stay tax-efficient.

If you’re a Director of a limited company, you likely need to file a personal tax return. Whether straightforward or involving investments, our team will prepare and submit your return to HMRC. We also provide advice on payments and strategies to reduce tax liability, such as pension contributions, ISAs, or tax-efficient schemes like the Enterprise Investment Scheme (EIS).

Our Personal Tax Services Include:

- Income tax planning

- Preparation of tax returns

- Personal tax advice on tax-efficient investments

- Capital gains tax planning

- Inheritance tax advice

- Making Tax Digital

- Assistance with personal tax disputes, including HMRC enquiries

We ensure your personal tax returns are accurate and submitted on time, guaranteeing compliance with HMRC regulations. Avoiding costly mistakes is a key benefit, while meeting legal requirements offers peace of mind.

Stay Compliant with Personalised Tax Planning.

Self-assessment is complex; however, with the right knowledge, you can avoid hassle and potentially save on tax.

As a self-employed business owner or landlord, calculating your tax liability can be challenging, especially when managing property, foreign income, dividends, and capital gains. A skilled accountant ensures your decisions are tax-efficient and helps you avoid costly mistakes.

Once your tax planning is complete, we’ll handle the calculations, file your return with HMRC, and advise you on your tax bill and payment deadlines. As an independently owned firm, we offer regular reviews to support year-round tax-efficient decisions and guide you through Making Tax Digital (MTD) for full compliance.

You are responsible for calculating your tax liability and registering with HMRC. You must register for self-assessment by 5 October following the end of the tax year. Tax returns are due by 31 January each year. This process can be complicated, and managing tax returns can be stressful, especially when juggling property, foreign income, dividends, and capital gains taxes.

Why Hire an Professional Accountant for Your Tax Return?

Save Time and Reduce Stress

Having an accountant complete your tax return can save you a significant amount of administrative work and time. Additionally, ABS Accountancy offers much more than just basic filing.

Ensure Compliance and Accuracy

We will ensure that your personal tax returns are completed accurately and submitted on time, fully complying with HMRC regulations and current legislation. This approach not only helps you avoid costly mistakes but also provides peace of mind.

Maximise Savings and Minimise Costs

Furthermore, by avoiding expensive penalties, we will help you calculate relevant expenses accurately to ensure you’re not paying more tax than necessary. In fact, we actively seek out opportunities to save you as much money as possible.

Frequently Asked Questions

If you earn income from property or operate as a sole trader, it is your responsibility to notify HMRC. To help you with this, you can use the HMRC tool to determine whether you need to submit a personal tax return for your tax year.

There are numerous accounting software packages available for your personal tax return. In fact, HMRC provides a list of commercial software suppliers that allow you to submit your self-assessment tax returns directly to them. Additionally, you can also utilise HMRC’s free software by simply logging into your HMRC account and filling out your income tax return.

Making Tax Digital for income tax will be implemented in April 2026; therefore, you will need to use compatible software to submit your tax returns quarterly to HMRC. Here’s a list of HMRC-recognised software that complies with Making Tax Digital for income tax.

Yes, the good news is that accounting fees are fully tax-deductible, which means you can effectively reduce your overall tax liability.

Get in touch

If you’re seeking a professional, approachable, and friendly accountancy practice, you’ve found the right place.

Our team is here to provide personalised services, allowing you to focus on what truly matters, whether you’re an individual, sole trader, or owner-managed business.