Inheritance Tax for Farmers

Inheritance Tax for farmers Inheritance tax for farmers can be complex. Learn how to reduce liabilities with strategies like APR, BPR, gifting, and trusts. From April 2026, the government will restructure APR to ensure that a “small number of claimants” pay their share of inheritance tax (IHT). Nevertheless, despite strong opposition to the proposed changes […]

Insights into the Changes for the New Tax Year

Insights into the changes for the New Tax Year. The new tax year began on April 6th, ushering in revisions to tax rates, thresholds, and regulations. Our insights into the changes in the new tax year help individuals and businesses anticipate alterations and their potential impacts. For individuals, changes in tax rates and thresholds directly […]

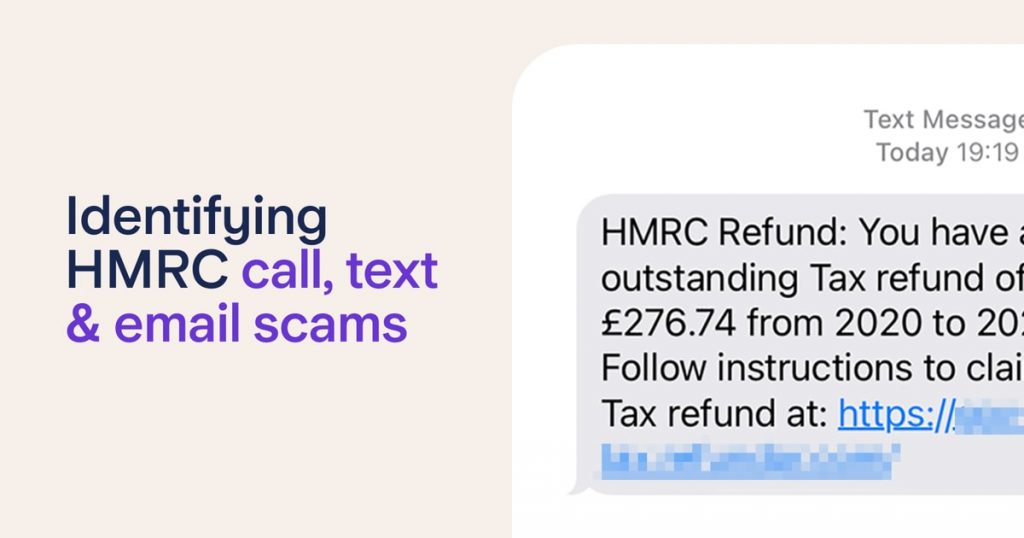

Combating HMRC Scammers

In the 12 months leading up to September 2023, HMRC has been actively combating scammers who impersonate them to target taxpayers. These scammers employ various tactics, such as offering tax rebates and making false threats regarding unpaid taxes. HMRC issued a warning to taxpayers, advising them to remain vigilant against scam attempts through text messages, […]

5 ways to please your accountant

Your accountant plays a crucial role in managing your finances; therefore, they are 5 ways to please your accountant. When it comes to maintaining a positive relationship with them, you can immediately take to keep your accountant happy, foster a harmonious professional bond, and enable them to deliver their optimal services for your small enterprise. […]